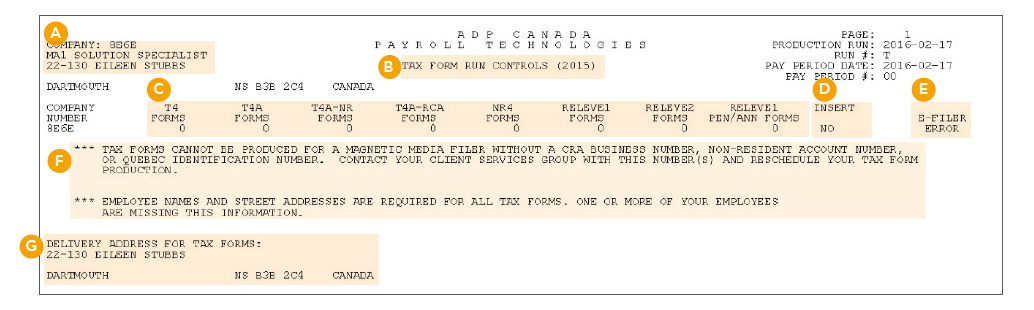

The Tax Form Controls Report contains information on the number of different tax forms that are produced and any error messages that may have caused for the tax forms not to run.

Company Name and Code

Report Title

Number of forms produced for each tax form type

These 2 columns identify if your company is setup to have your tax forms inserted and/or sealed into an envelope. The word "YES" will be populated as shown

Under the E-Filer column, you will be able to identify whether your company is setup to have ADP electronically file all your tax forms to the appropriate government agencies. By default, ADP Canada will automatically file your tax forms electronically and file the government copies directly with CRA and/or revenu Quebec on your behalf. Regardless of your filing option, you are still required to complete and return the revenu Quebec summary by filing deadline

This portion will state any errors that may have been produced during the trial run

Delivery Address for Tax Forms

The Report of Tax Form Balance provides you the total amounts for each tax form box by your business number based on your fiscal set up.

In the tax form trial run, you also get a preview of all test tax forms pertaining to your company results.

Your Company Code, Name and Address

Report Title

Page Number, Run Date, Pay Period Date, and Pay Period Number

Business Number/Tax Packet

Tax Forms Fields - All the fields that are on the tax forms will be displayed on this column

Payroll Register/Totals Recap - Payroll Register and Totals Recap column is extracted from the Payroll master file. The amounts in this column can also be found in the Payroll Register, Totals Recap, Totals and/or Daily Update Reports depending on whether they are deductions or earnings

Tax Forms - The amounts in this are reported in the tax forms. Generally, these amounts should match the Totals Report and Payroll Register, however, if they do not match then please contact your ADP representative

Difference -The Difference column states the difference between the Payrolls Register and Totals Recap column and tax forms column. If there are any values other than 0 in the difference column, then you will need to refer to employees with differences section within this report

Form Type - Shows the type of tax form. For example, T4 form or T4A form or Releve 1 form

Box – The box column represents which tax form box or code number will be reported with the value from the Tax Form column totals

If you have multiple business numbers, multiple sections will be produced. Box by Box Totals are provided for all employees by the business number that the employee is under. In this report, federal and Quebec totals are separated by section.

The T4 Form is a commonly produced document that is produced for each employee and contains their applicable earnings and deductions.

Quebec employees will receive a releve 1 form which is produced in French